Collection Letter Response

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Collection Letter Response

微软的词 (.docx)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (24.47 kB)

- 语: English

Sponsored Link

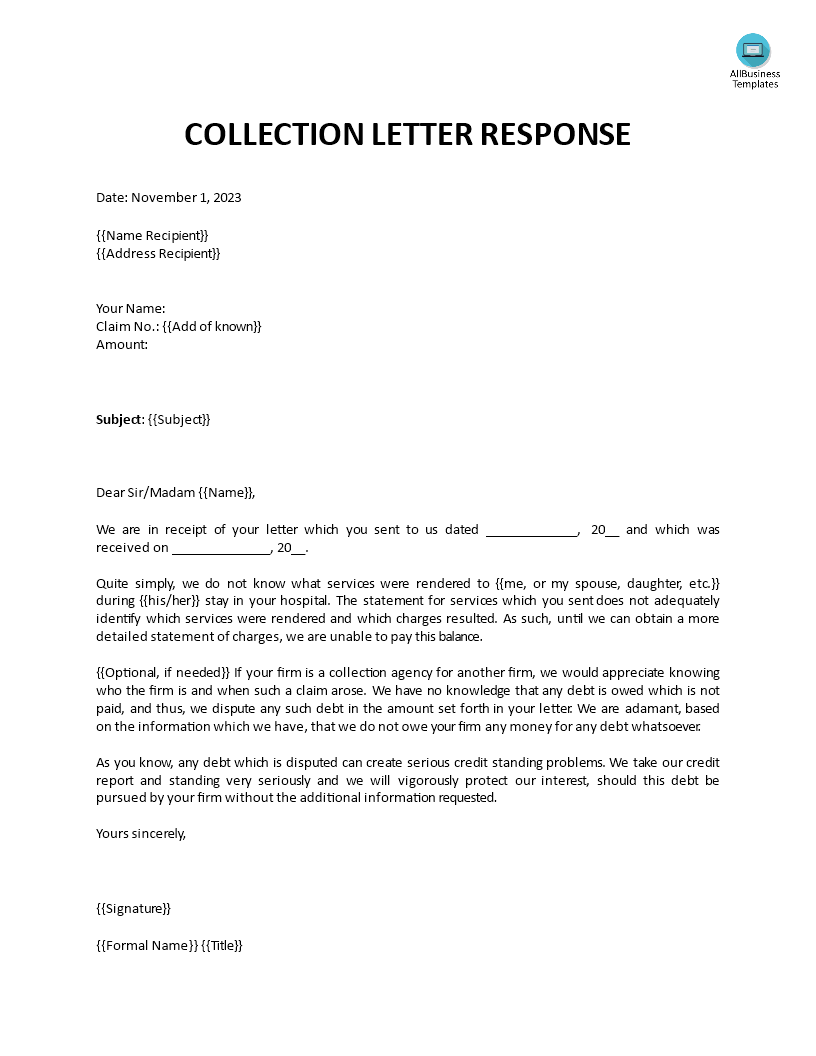

How to draft a collection letter response? When a collection letter has been sent to you. What should I do? Our collection letter response template is perfect for those who need to write a formal response to a collection letter. It includes all the information you need to include, such as the reason for the response, any payment arrangements, and the next steps. Continue reading below to learn more about collection letters and download our template, then modify it according to your needs.

A Collection Letter Response, often referred to as a response to a debt collection letter or simply a debt response letter, is a written communication from a debtor or person owing money to a creditor or collection agency in response to a collection letter or notice they have received. Collection letters are typically sent when a debt becomes overdue, and the creditor or collection agency is seeking payment or resolution of the debt.

Here are key points about a Collection Letter Response:

- Purpose: The primary purpose of a Collection Letter Response is to address the debt or financial obligation outlined in the collection letter. It allows the debtor to communicate with the creditor or collection agency regarding the debt, including discussing payment arrangements, disputing the debt, or seeking additional information.

- Content: The content of a Collection Letter Response can vary depending on the debtor's circumstances and intentions. It may include:

- Acknowledgment of the debt.

- Confirmation of the debt's validity.

- Explanation of any disputes or errors related to the debt.

- Negotiation of a repayment plan or settlement.

- Request for more information or documentation regarding the debt.

- Explanation of financial hardship that may affect the ability to pay.

- A formal dispute of the debt if the debtor believes it is incorrect or has been unfairly assessed.

- Timeliness: Debtors typically have a limited amount of time to respond to a collection letter, depending on local regulations and the terms outlined in the letter. It is often advisable to respond promptly to address the debt and avoid further collection actions.

- Dispute Resolution: If the debtor disputes the debt's validity or accuracy, the creditor or collection agency may need to provide additional documentation or information to support the debt's legitimacy. The response may be a starting point for resolving any disputes.

- Negotiation: Debtors who are unable to pay the full amount owed may use the response to propose a repayment plan or negotiate a settlement with the creditor or collection agency.

- Documentation: It is essential to maintain copies of all correspondence related to debt collection, including the Collection Letter Response. This documentation can be valuable in case of future disputes or legal actions.

- Legal Considerations: Debtors should be aware of their rights under debt collection laws, which can vary by jurisdiction. Some regulations govern the conduct of collection agencies and provide protections for debtors.

Responding to a Collection Letter is an important step in managing debt and resolving financial obligations. Debtors are encouraged to communicate honestly with creditors or collection agencies and seek legal or financial advice if they have concerns or disputes related to the debt collection process. Additionally, keeping records of all communication is crucial to protect one's rights and interests.

To respond to a collection letter, follow these steps:

- Carefully read the letter to understand the debt details and deadlines.

- Validate the debt if you have doubts about its accuracy.

- Assess your financial situation.

- Decide on an appropriate response based on your circumstances (pay in full, negotiate a payment plan, dispute the debt, or explain financial hardship).

- Contact the creditor or collection agency to discuss your response.

- Keep records of all communication and correspondence.

- Be aware of legal timeframes and deadlines.

- Seek legal or financial advice if needed.

Follow through with any agreed-upon payment plan or resolution.

Remember your rights as a consumer, and ensure that the creditor or collection agency follows applicable debt collection laws and regulations.

We provide this standardized Collection Letter Response template with text and formatting as a starting point to help professionalize the way you are working. Our private, business, and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you save time and focus on the topics that matter!

Using this document template guarantees you will save time, cost, and effort! It comes in Microsoft Office format and is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Collection Letter Response template now for your benefit!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link