Assignment Of Savings Account Form

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Assignment Of Savings Account Form

微软的词 (.doc)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (55 kB)

- 语: English

Sponsored Link

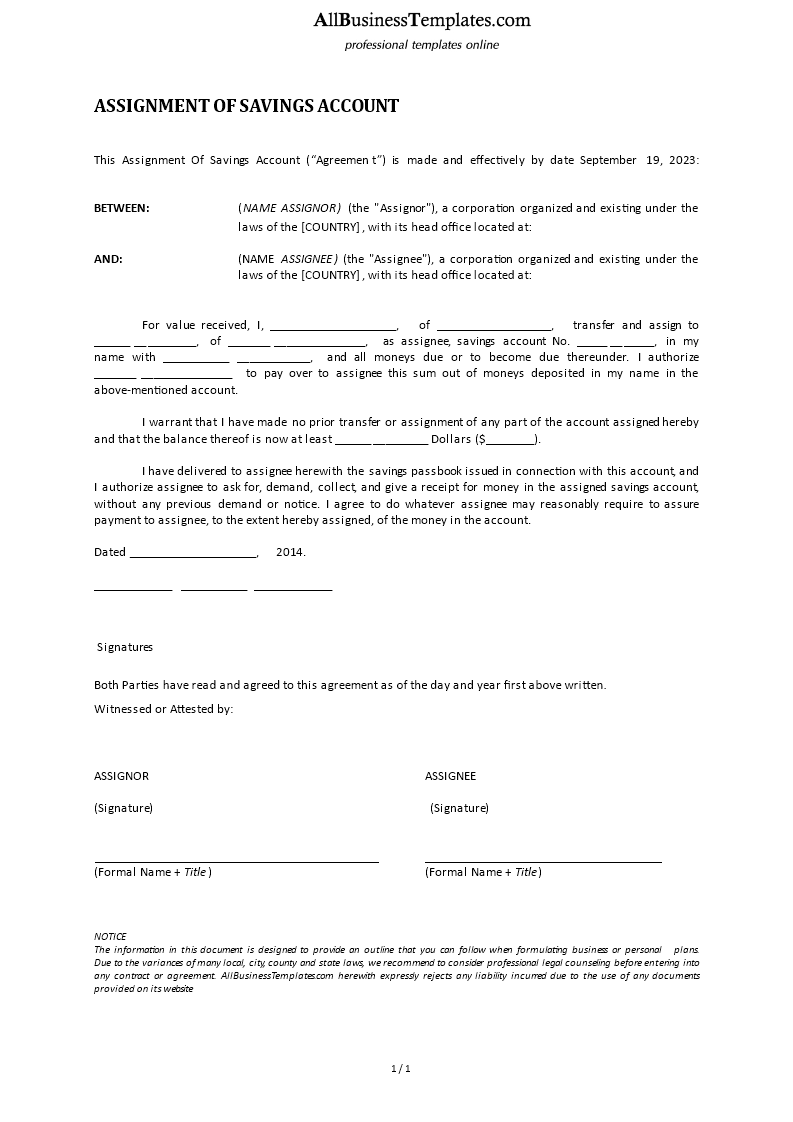

What is the purpose of an assignment of savings? Where can I find the Assignment Of Savings Account Form? We have got you covered. Our Assignment Of Savings Account Form template can be downloaded and fully customizable. It can be used to create and print your own quickly and easily. Download our template now and get started!

An "Assignment of Savings Account Form" is a legal document that allows an account holder to transfer or assign ownership or rights related to a savings account to another individual or entity. This type of form is typically used in financial or legal transactions where the account holder wants to grant specific rights or responsibilities to someone else. Here are some key points to understand about the Assignment of Savings Account Form:

- Transfer of Ownership: The form allows the account holder (the assignor) to transfer ownership of the savings account to another person or entity (the assignee). This means that the assignee will have control over the account and may have the authority to make withdrawals, deposits, and other financial decisions related to the account.

- Specific Rights: The form can be customized to specify the rights or responsibilities being assigned. For example, the assignor may grant the assignee the right to manage the account but not the right to close it.

- Legal Considerations: Assigning a savings account is a legal transaction, and it may be subject to certain legal requirements and regulations depending on the jurisdiction and the financial institution. It's essential to follow the applicable laws and guidelines when using this form.

- Financial Institution Requirements: Some financial institutions have their own procedures and forms for transferring ownership or assigning rights to accounts. Account holders should check with their bank or credit union to ensure they use the correct form and comply with any institution-specific requirements.

- Notarization: In some cases, the Assignment of Savings Account Form may require notarization or witness signatures to validate the transaction. This adds an extra layer of legal authenticity to the assignment.

- Revocable or Irrevocable: Depending on the terms specified in the form, the assignment may be revocable (able to be canceled or revoked by the assignor) or irrevocable (cannot be canceled without the assignee's consent).

- Purpose: The assignment of savings accounts can serve various purposes, such as estate planning, gifting assets, or delegating financial management responsibilities.

- Legal Advice: Given the legal and financial implications of assigning a savings account, it is advisable for both the assignor and assignee to seek legal advice before completing the form, especially if it is part of a broader financial or estate plan.

- Record Keeping: It is crucial to keep a record of the completed Assignment of Savings Account Form for documentation and reference purposes.

Overall, the Assignment of Savings Account Form is a tool that allows individuals to transfer ownership or specific rights related to their savings accounts. It should be used with care and in compliance with relevant laws and regulations.

Download our Assignment Of Savings Account Form template now and start managing your savings account with ease. It is the perfect solution for anyone looking to manage their savings account.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link