Advanced Income Statement

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Advanced Income Statement

微软电子表格 (.xls)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (36.5 kB)

- 语: English

Sponsored Link

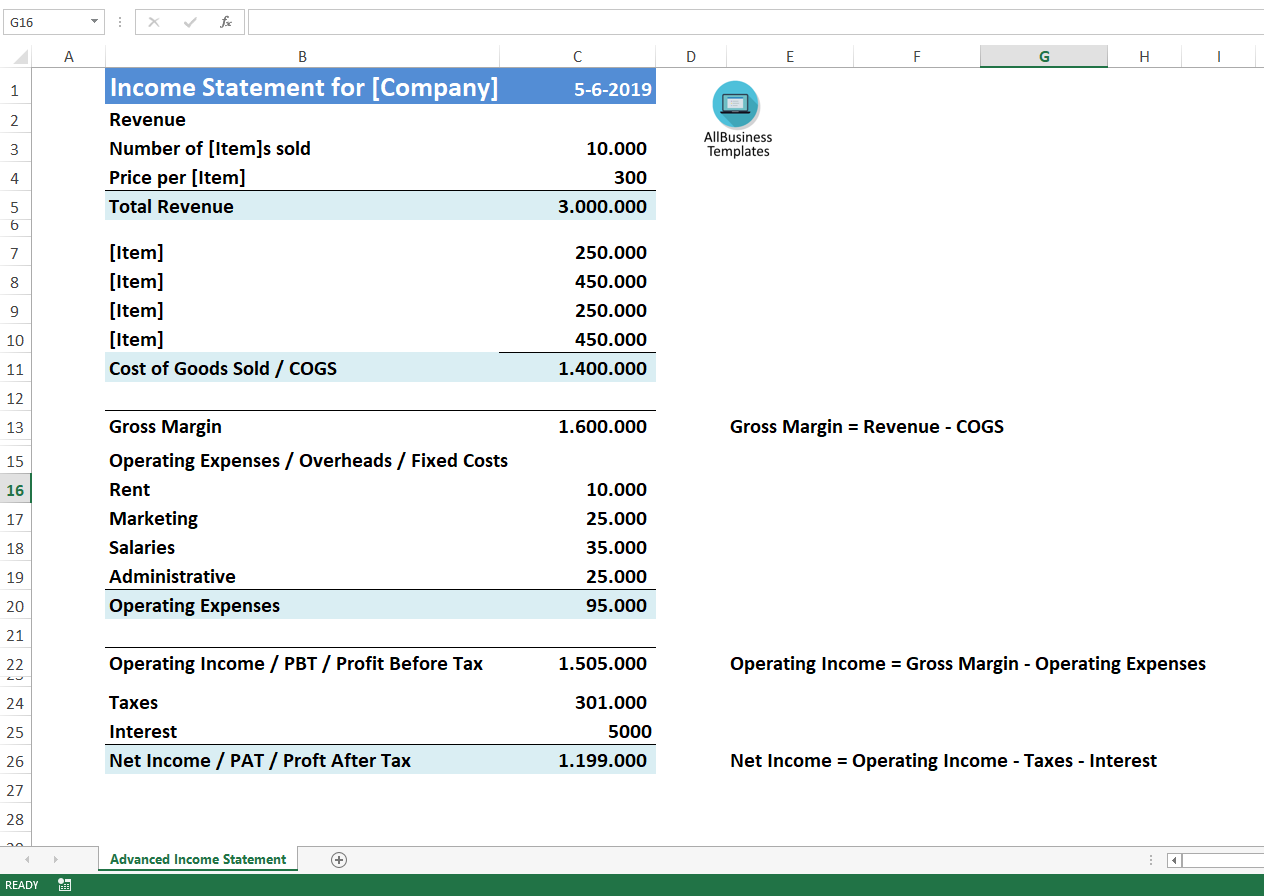

How to create an Advanced Income Statement in Excel? Download this Advanced Income Statement template now!

An advanced income statement spreadsheet, often referred to as a financial statement or profit and loss statement (P&L), is a tool used in accounting and financial analysis to summarize a company's revenues, expenses, and profits over a specific period of time, typically a month, quarter, or year. It provides a detailed breakdown of a company's financial performance, allowing stakeholders to assess its profitability and make informed business decisions.

The following indicators or key components are typically found in an advanced income statement spreadsheet of a company:

Revenue

Number of Pizzas sold

Price per Pizza

Total Revenue

Cost of Goods Sold / COGS

Gross Margin (Gross Margin = Revenue - COGS)

Operating Expenses / Overheads / Fixed Costs

Rent

Marketing

Salaries

Administrative

Operating Expenses

Operating Income / PBT / Profit Before Tax

(Operating Income = Gross Margin - Operating Expenses)

(Operating Income = Gross Margin - Operating Expenses)

Taxes

Interest

Net Income / PAT / Proft After Tax

(Net Income = Operating Income - Taxes - Interest)

Explanation:

Here are some key components typically found in an advanced income statement spreadsheet:

Revenue: This section includes all sources of income generated by the company, such as sales, service fees, interest income, and any other income streams. It may also break down revenue by product or service categories.

Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or delivering the company's products or services. It includes expenses like raw materials, labor, and manufacturing overhead.

Gross Profit: Gross profit is calculated by subtracting COGS from total revenue and represents the profit earned before deducting operating expenses.

Operating Expenses: This section includes all expenses not directly tied to the production of goods or services, such as salaries, rent, utilities, marketing, and administrative costs.

Operating Income (Operating Profit): Operating income is the result of subtracting operating expenses from the gross profit. It reflects the profitability of the company's core operations.

Other Income and Expenses: This category may include non-operating income or expenses, such as interest income, interest expenses, gains or losses from investments, and other miscellaneous items.

Income Before Taxes: This figure represents the company's profit before accounting for income taxes.

Income Tax Expense: It shows the amount of taxes the company owes based on its taxable income.

Net Income (Profit): Net income is the final figure on the income statement, representing the company's overall profit after all expenses, including taxes.

Earnings per Share (EPS): If applicable, this calculates the earnings per share for publicly-traded companies, which is often important for investors.

Advanced income statement spreadsheets are typically created using spreadsheet software like Microsoft Excel or Google Sheets and can be customized to suit the specific needs and reporting standards of a particular business or industry. An advanced income statement spreadsheet may also include additional sections or subcategories depending on the complexity of the business or the specific reporting requirements. It's a crucial financial tool for businesses, investors, creditors, and analysts to assess financial performance and make strategic decisions.

Using our financial templates guarantees you will save time, cost and efforts!

Fast, safe and easy!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link