Blank Business Credit Application Template

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Blank Business Credit Application Template

微软的词 (.docx)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (17.6 kB)

- 语: English

Sponsored Link

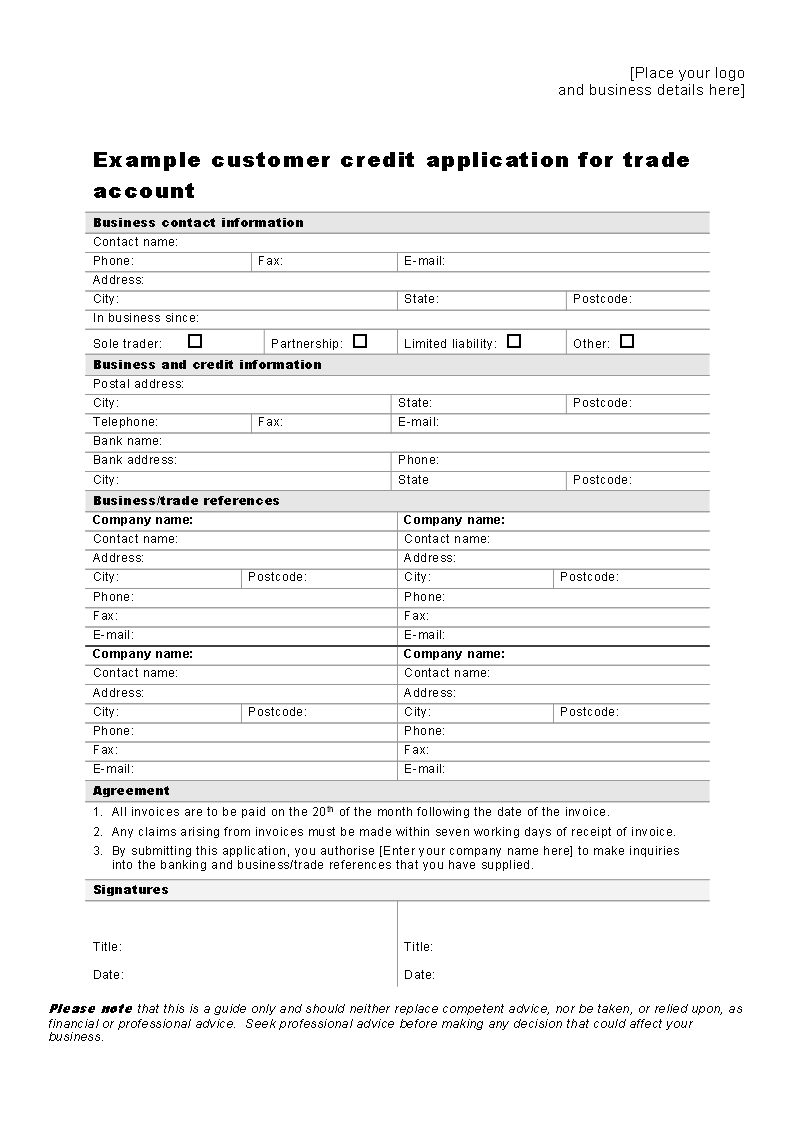

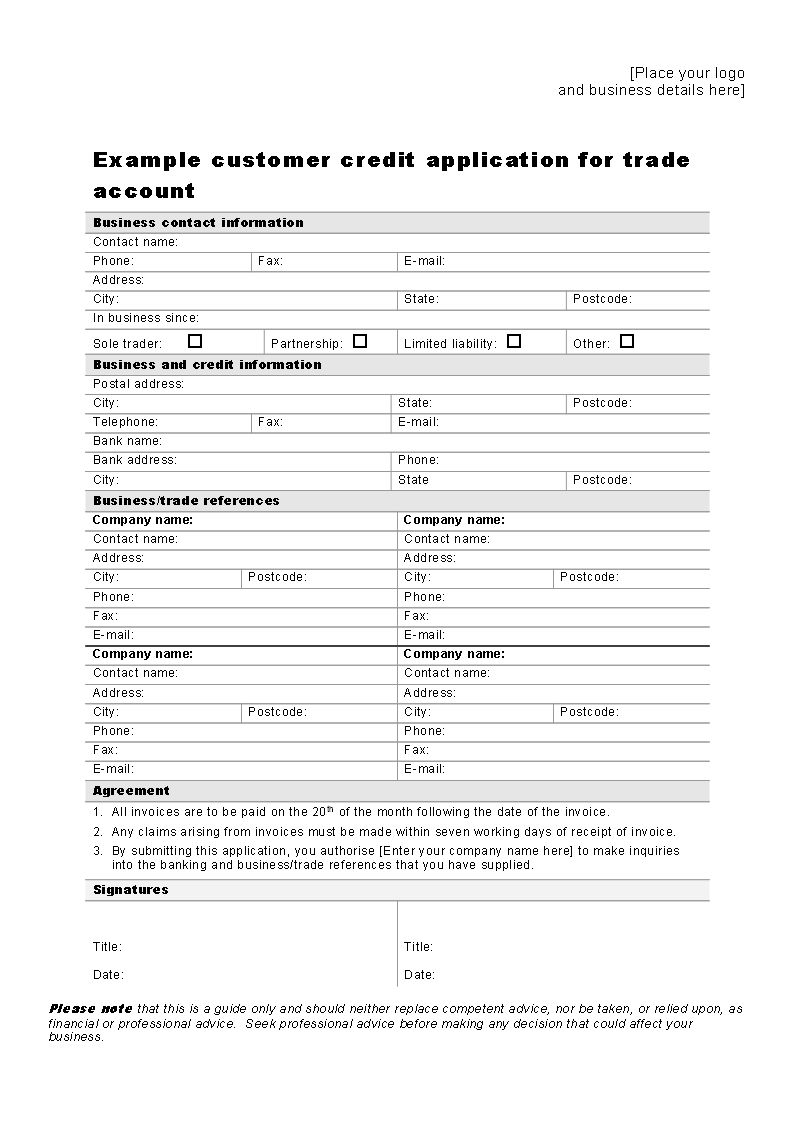

How to create a Business Credit Application Form?

A Business Credit Application Form is a crucial document for assessing the creditworthiness of potential clients. It collects essential financial and personal information to help businesses make informed decisions about extending credit.

The first blow is half the battle! Having your finance organized is often an important part of getting ready for your project. Nowadays the internet creates more transparency in markets, people learn quicker, which makes the current players more competitive. Key Components:

Business Information:

- Business name, address, phone number, and email address.

- Type of business (corporation, partnership, sole proprietorship, LLC).

- Years in business and relevant tax IDs.

Owner/Principal Information:

- Personal details of the business owner(s) or principal(s), including social security numbers and home addresses.

Banking Information:

- Details of the business’s bank accounts, including account numbers and bank contact information.

Trade References:

Contact information for trade references that can vouch for the business’s credit history.

Credit Request Details:

The amount of credit requested and its intended use.

Legal Clauses and Agreements:

- Terms and conditions, including payment deadlines, interest rates, and credit limits.

- A personal guarantee clause ensuring repayment, enhancing the security of the credit extended.

- Consent for credit checks and authorization to verify the provided information.

We provide a blank Business Credit Application Template template that suits your needs! By using this form for applying a business credit application, you will take a head start and you will see you will save time, increase your effectiveness.

Download this Business Credit Application Form now or check out any of our other Business Credit Application Forms here.

For more business plan templates? Just browse through our business plan database! You will have instant access to hundreds of free and premium ready-made business plan templates.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link