Shareholder New Assumption Agreement

Sponsored Link高级模板 保存,填空,打印,三步搞定!

下载 下载 How to set up a Shareholder New Assumption Agreement? How do new shareholders sign a shareholders agreement? this Shareholder New Assumption Agreement now!

只有今天: USD 2.99

点击购买

可用的免费文件格式:

微软的词 (.docx)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (26.69 kB)

- 语: English

- 付款完成后,您将收到包含该文件的电子邮件。

Sponsored Link

How to set up a Shareholder New Assumption Agreement? How do new shareholders sign a shareholders agreement? Our Shareholder New Assumption Agreement template is comprehensive and easy to use. It will help you ensure that all necessary information and terms are accurately recorded and that all stakeholders are on the same page. Download this Shareholder New Assumption Agreement now!

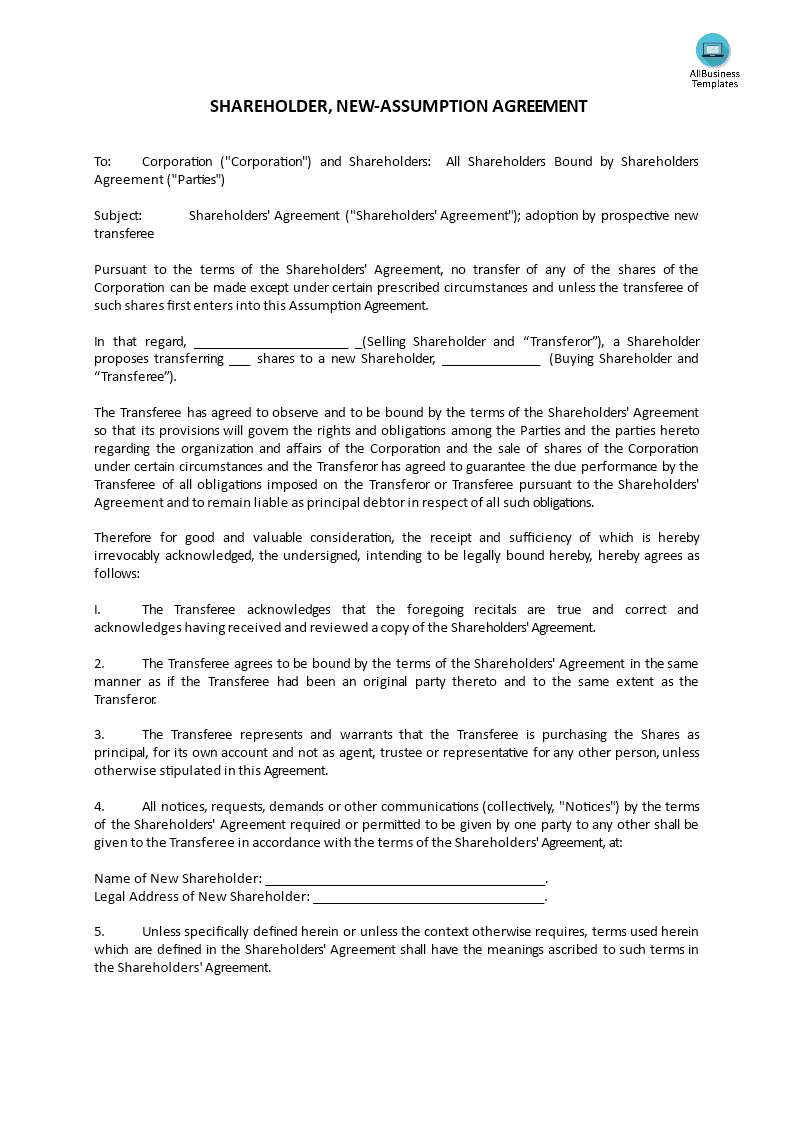

A Shareholder New Assumption Agreement is a legal document used in corporate transactions, such as mergers, acquisitions, or reorganizations, to formalize the transfer of certain assets, liabilities, or obligations from one entity to another, often in the context of a change in ownership or structure. In the context of a corporation, it typically relates to the transfer of ownership or shares from one shareholder to another or from one entity to another.

Here are some key elements and considerations related to a Shareholder New Assumption Agreement:

- Transfer of Ownership: In the context of a corporation, the agreement may be used to document the transfer of shares of stock from one shareholder to another or from one entity to another. This transfer of ownership often occurs as part of a larger corporate transaction.

- Assumption of Obligations: The agreement specifies which obligations, responsibilities, or liabilities are being assumed by the new shareholder or entity as a result of the share transfer. These obligations could include contractual commitments, debts, or legal liabilities.

- Consideration: The agreement may outline the consideration (payment or other assets) being provided by the new shareholder or entity to the transferring shareholder in exchange for the shares. This is typically a key element of the agreement.

- Conditions: Conditions precedent to the share transfer and assumption of obligations may be outlined. These conditions might include regulatory approvals, third-party consents, or other requirements that must be met before the transfer can occur.

- Release of Liability: Provisions related to the release of the transferring shareholder from certain liabilities or obligations may be included. This can help protect the transferring shareholder from future claims related to the assets or liabilities being transferred.

- Governing Law: The agreement often specifies the jurisdiction and governing law that will apply to any disputes related to the agreement.

- Signatures: It must be signed by all relevant parties, including the transferring shareholder, the new shareholder or entity, and any necessary witnesses or representatives.

Shareholder New Assumption Agreements are commonly used in corporate transactions to facilitate the transfer of ownership interests and assets while providing clarity and legal documentation of the responsibilities and obligations involved.

Download this professional legal Shareholder New Assumption Agreement template if you find yourself in this situation and save yourself time, and effort and probably reduce some of the lawyer fees! Using our legal templates will help you reach the next level of success in your education, work, and business! However, we still recommend you to consider consulting a local law firm in case of doubt to support you in this matter.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link