AIRBNB Rental Property Investment Calculator

Sponsored Link高级模板 保存,填空,打印,三步搞定!

下载 下载 Are you going to invest in a short-stay rental investment property? Need an easy-to-use Rental Property Investment Calculator? this short stay rental investment analysis template.

只有今天: USD 4.98

点击购买

可用的免费文件格式:

微软电子表格 (.xlsx)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (34.42 kB)

- 语: English

- 付款完成后,您将收到包含该文件的电子邮件。

Sponsored Link

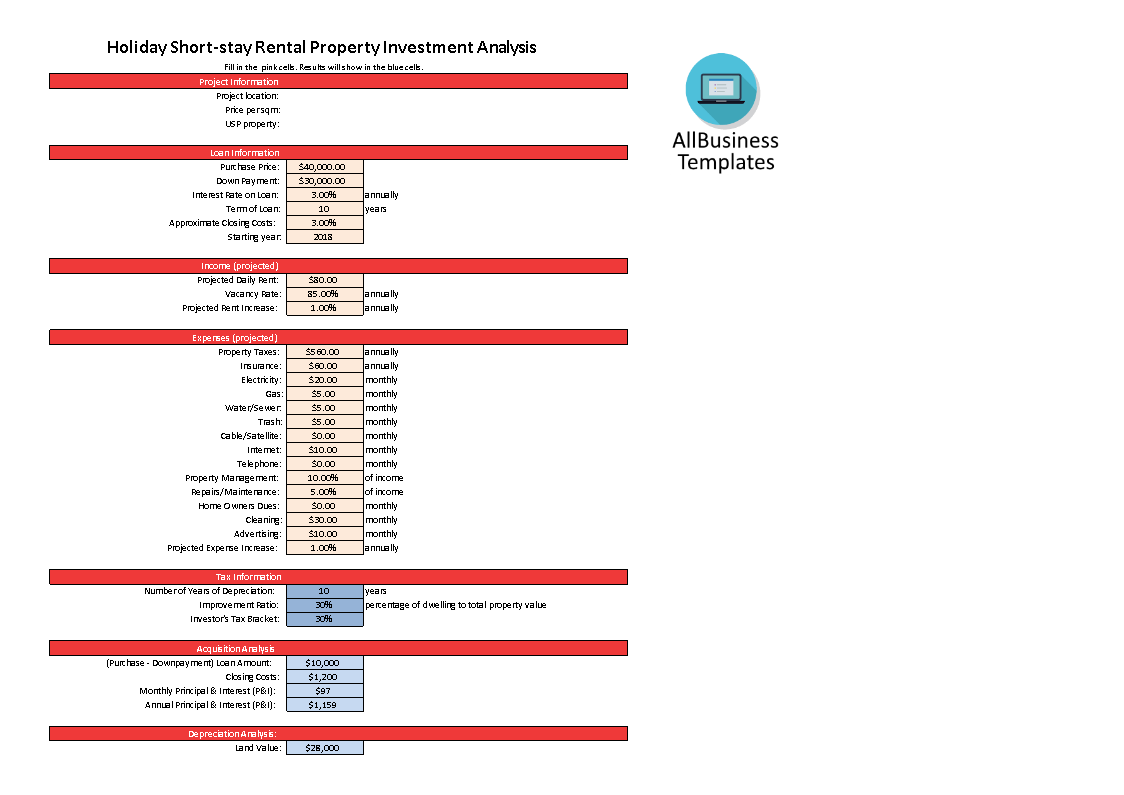

Are you going to invest in a short-stay rental investment property? Need an easy-to-use Rental Property Investment Calculator? Our rental property investment calculator template is designed to help you quickly and easily calculate how much you can earn from a rental property investment. Download this Short-stay rental investment analysis template now to calculate your gross profit, net profit, cash flow, return on investment, etc!

A Rental Property Investment Calculator is a financial tool or software application that helps real estate investors assess the potential financial performance of a rental property. It allows investors to analyze the financial feasibility of purchasing and owning rental properties by estimating various financial metrics, such as cash flow, return on investment (ROI), and profitability.

Here are some common features and calculations that a Rental Property Investment Calculator typically includes:

- Property Information: Users input details about the rental property, including its purchase price, down payment, loan terms (if applicable), property taxes, insurance, and other associated costs.

- Rental Income: Users enter the expected rental income generated by the property, which may include monthly or annual rent amounts.

- Expenses: Users input various expenses related to the property, such as property management fees, maintenance costs, property taxes, insurance premiums, utilities, and homeowner association (HOA) fees.

- Financing Information: If the property is financed with a mortgage, users can input details about the loan, including the interest rate, loan term, and down payment.

- Vacancy Rate: An estimation of the percentage of time the property is expected to remain vacant without generating rental income.

- Appreciation: The expected annual property appreciation rate, which represents the potential increase in the property's value over time.

- Selling Costs: Estimated costs associated with selling the property in the future, including real estate agent commissions and closing costs.

Based on the information provided, a Rental Property Investment Calculator can generate various financial metrics and projections, including:

- Cash Flow: The calculator determines whether the property is expected to generate positive or negative cash flow each month or year.

- Cap Rate (Capitalization Rate): A measure of the property's potential return on investment, calculated by dividing the property's net operating income by its purchase price.

- Cash-on-Cash Return: A measure of the return on the cash invested in the property, calculated by dividing the annual cash flow by the initial cash investment.

- Return on Investment (ROI): The overall return on investment, which takes into account both cash flow and property appreciation.

- Break-Even Point: The point at which the rental property covers all expenses and begins generating a profit.

- Return on Equity (ROE): A measure of the return on the owner's equity in the property, considering both cash flow and property appreciation.

- Profitability Timeline: An estimate of how long it will take for the property to become profitable or reach a certain ROI.

Rental Property Investment Calculators are valuable tools for real estate investors to assess potential investments, compare different properties, and make informed decisions about whether a rental property aligns with their financial goals.

Airbnb and other short-term rental sites are a very welcome and important source of supplemental income for many people nowadays. This easy-to-use Excel investment template helps you to make property investment calculations with the purpose of renting out holiday short-stay accommodation.

We provide a short-term rental investment Excel analysis template that will support your plan to invest in short-term rental projects. It comes with a table and a chart. Our templates are all in use by real estate professionals.

Using our real estate investment templates guarantees you will save time, costs, and effort, and are helping you to reach the next level of success in your work and business!

After downloading and filling in the blanks in the Excel file, you can customize every detail and appearance of your analysis and chart and finish your thorough calculation in minutes.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link