Business Tax Planning Charted Accountant Resume

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Business Tax Planning Charted Accountant Resume

Adobe PDF (.pdf)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (14.94 kB)

- 语: English

Sponsored Link

How to draft a Business Tax Planning Charted Accountant Resume that will impress? How to grab your futures employers’ attention when you are applying for a new job? Download this Business Tax Planning Charted Accountant Resume template now!

There are a few basic requirements for a Resume, for example, the resume should contain the following:

This Business Tax Planning Charted Accountant Resume template will grab your future employer its attention. After downloading and filling in the blanks, you can customize every detail and appearance of your resume and finish.

In order to achieve this, you just have to be a little more creative and follow the local business conventions. Also bright up your past jobs and duties performed. Often they are looking for someone who wants to learn and who has transferable skills like:

- Leadership skills;

- Can do-will do mentality;

- Ability to communicate;

- Ability to multi-task;

- Hard work ethics;

- Creativity;

- Problem-solving ability.

- brief, preferably one page in length;

- clean, error-free, and easy to read;

- structured and written to highlight your strengths;

- immediately clear about your name and the position you are seeking.

Completing your Business Tax Planning Charted Accountant Resume has never been easier, and will be finished within in minutes... Download it now!

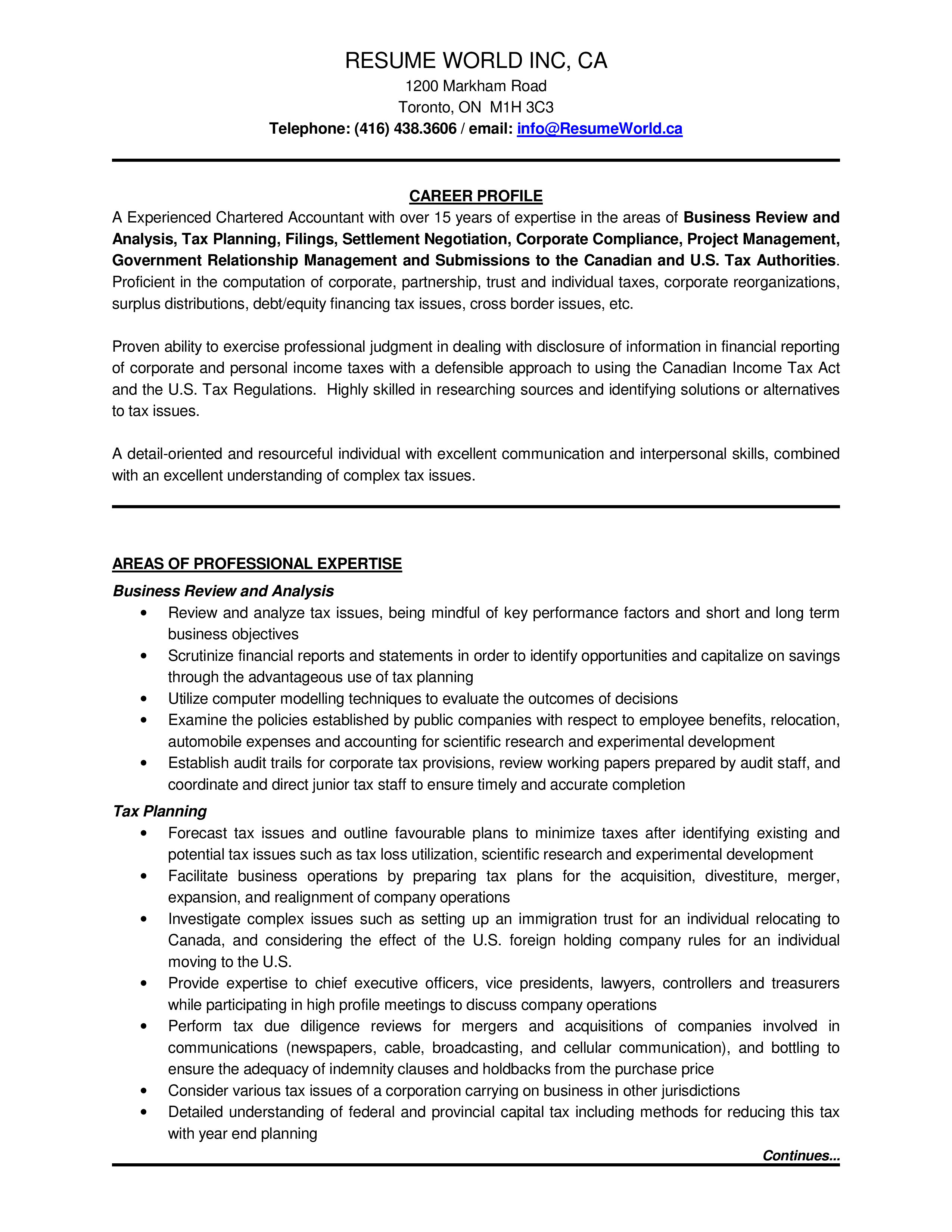

AREAS OF PROFESSIONAL EXPERTISE Business Review and Analysis • Review and analyze tax issues, being mindful of key performance factors and short and long term business objectives • Scrutinize financial reports and statements in order to identify opportunities and capitalize on savings through the advantageous use of tax planning • Utilize computer modelling techniques to evaluate the outcomes of decisions • Examine the policies established by public companies with respect to employee benefits, relocation, automobile expenses and accounting for scientific research and experimental development • Establish audit trails for corporate tax provisions, review working papers prepared by audit staff, and coordinate and direct junior tax staff to ensure timely and accurate completion Tax Planning • Forecast tax issues and outline favourable plans to minimize taxes after identifying existing and potential tax issues such as tax loss utilization, scientific research and experimental development • Facilitate business operations by preparing tax plans for the acquisition, divestiture, merger, expansion, and realignment of company operations • Investigate complex issues such as setting up an immigration trust for an individual relocating to Canada, and considering the effect of the U.S. foreign holding company rules for an individual moving to the U.S. • Provide expertise to chief executive officers, vice presidents, lawyers, controllers and treasurers while participating in high profile meetings to discuss company operations • Perform tax due diligence reviews for mergers and acquisitions of companies involved in communications (newspapers, cable, broadcasting, and cellular communication), and bottling to ensure the adequacy of indemnity clauses and holdbacks from the purchase price • Consider various tax issues of a corporation carrying on business in other jurisdictions • Detailed understanding of federal and provincial capital tax including methods for reducing this tax with

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布