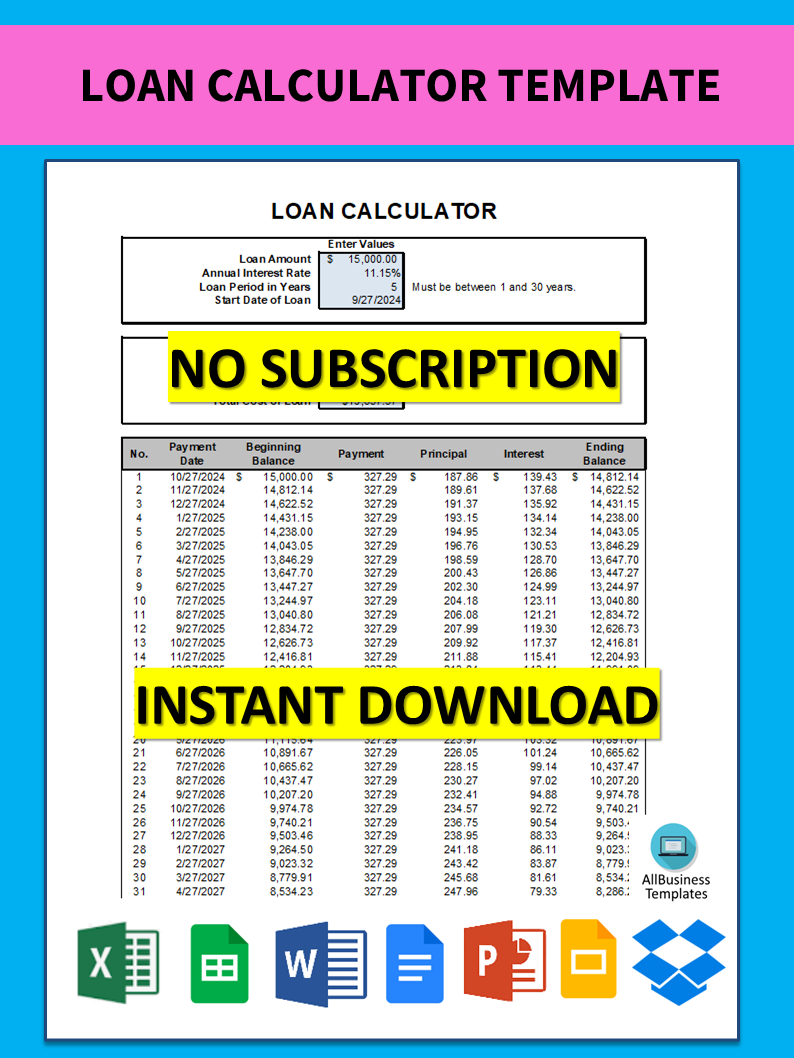

Loan Calculator

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Loan Calculator

微软电子表格 (.xlsx)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (78.24 kB)

- 语: English

Sponsored Link

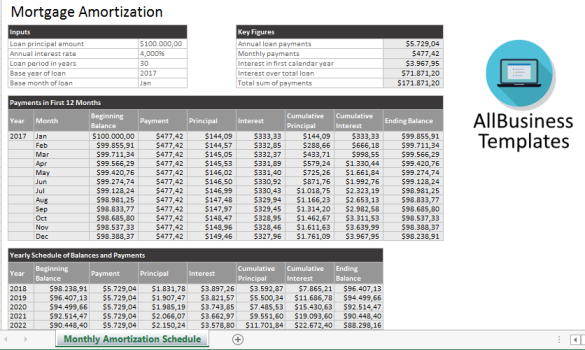

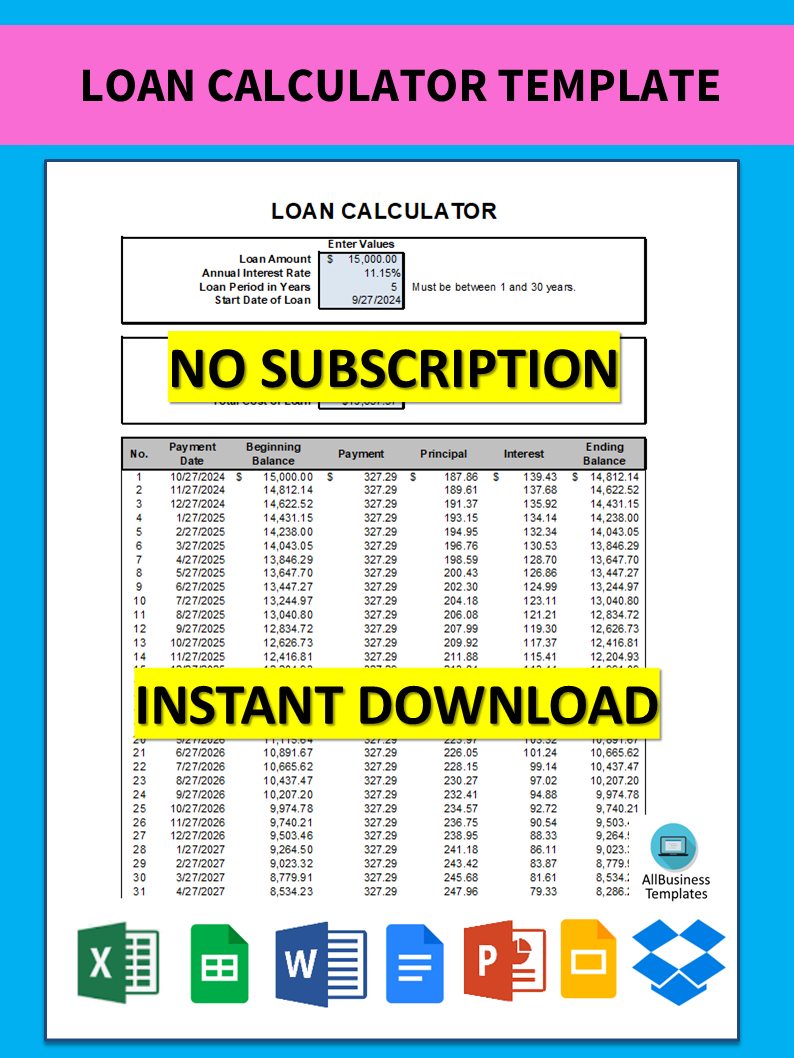

Why you should use a loan calculator template? Do you desperately need a loan calculator sample in an Excel template? Well, you have come to the right place for help. Our loan calculator template is free to use, simple, and has all the provisions for the calculation of your loan repayments.

A loan calculator template helps a lot both individuals and companies when they need to evaluate how much they will have to pay, what interest will be charged, or even what the entire loan will cost. In this article, we will demonstrate a primary reason for using a loan calculator template as well its advantages and provide the reader with a guide on how to make a loan calculator template with ease.

Why use a loan calculator template?

A loan calculator template is particularly important for borrowers or lenders who are involved in loans up to a certain economic capacity. It assists in performing the following tasks:

- Calculating expected loan average repayments and average interest

- Estimating the total cost of borrowing

- Justifying and evaluating loans

- Strategic thinking about lending money

Advantages of using a loan calculator template

Transforming text or images into another language using a loan calculator template has its share of advantages such as:

- Precision: Considering a loan calculator template, there are no chances of incorrect working.

- Expenditure cutting: There is a reduction in the calculation of interest or loan repayment in a loan calculator template.

- Proper assessment: Employing a loan calculator template assists people or organizations in assessments involving debt acquisition.

The composing of a worksheet in such a way that a loan calculator template is presented is an easy task that can be done in several minutes. Thus the help of the procedures has been discussed in this post and now you will be able to even incorporate a loan calculator template for your use.

This loan calculator will help you determine the monthly payments on a loan. Simply enter the loan amount, loan period in years, and annual interest rate. The calculator will automatically calculate the results.

What is the interest rate?

Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both interest and fees. The rate usually published by banks for saving accounts, money market accounts and CDs is the annual percentage yield, or APY.

Our Excel templates are grid-based files designed to organize information and perform calculations with scalable entries. Beginners and professionals from all over the world are now using spreadsheets to create tables, calculations, comparisons, overviews, etc for any personal or business need.

Click directly on ‘Open with Google Docs’ or obtain our sample loan calculator template as a Word template right away to boost productivity! The completion of an organized and efficient loan calculator is of great importance to you.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link