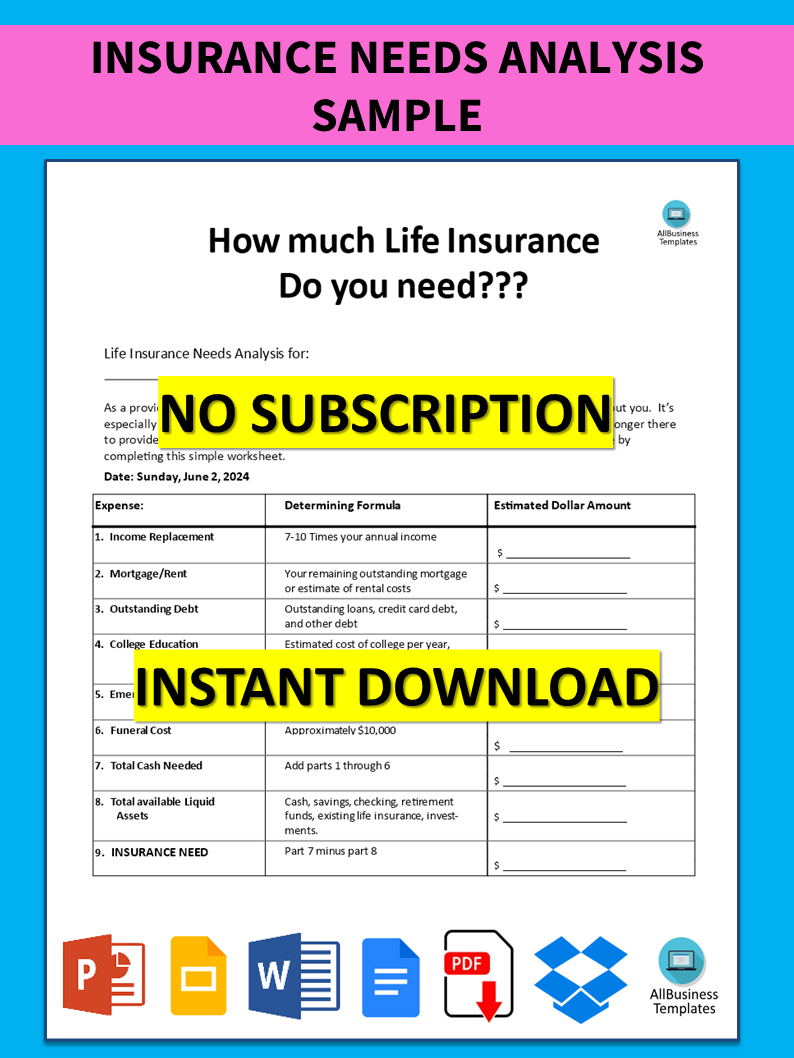

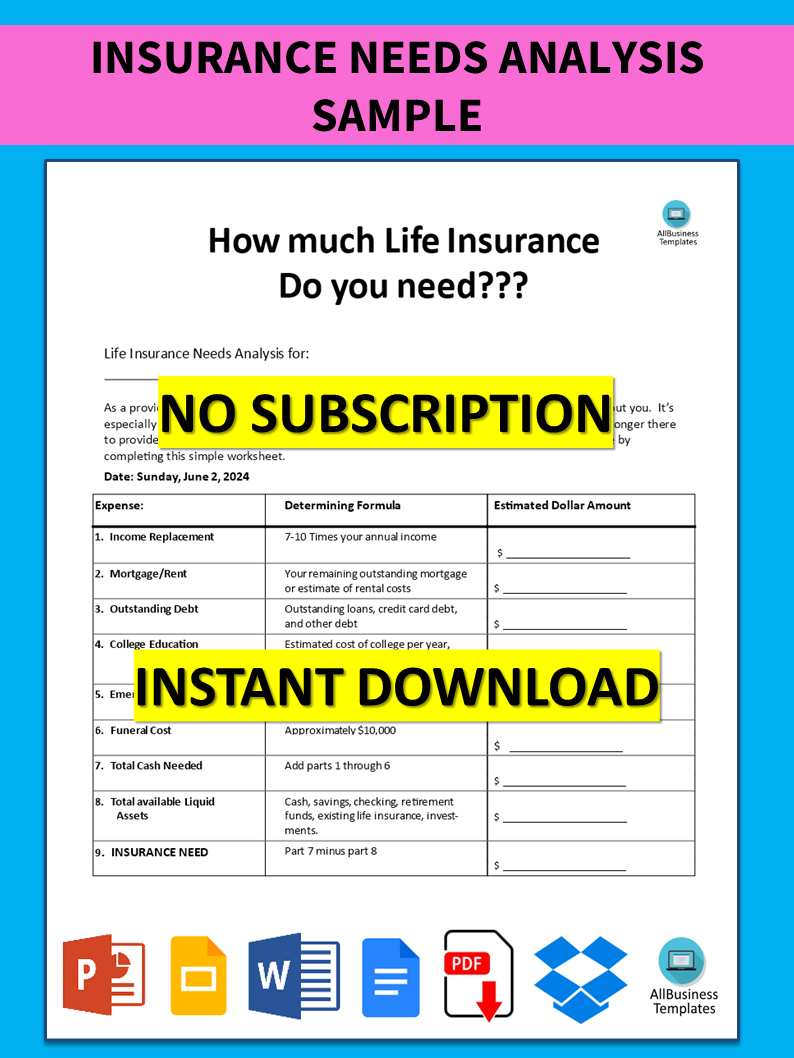

Insurance Needs Analysis Sample

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Insurance Needs Analysis Sample

微软的词 (.docx)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (27.88 kB)

- 语: English

Sponsored Link

How come insurance needs analyses are required? Do you require a model for evaluating insurance needs? This template can assist insurance companies in determining and comprehending the insurance needs of their customers. It can be utilized to develop an all-encompassing insurance policy that addresses the requirements of the client.

An insurance needs analysis is a methodical process of establishing the insurance needs of a person or company. The main objective is to ascertain what kinds and how much insurance coverage is necessary for adequate protection against possible risks and loss of money. It also assists in making sure that customers are neither underinsured nor overinsured, thus providing the best coverage at a moderate cost.

How to conduct insurance needs analysis

- Determine the Current Situation

- Personal Details: Age, marital status, number of dependents, health condition, occupation, income and debts.

- Existing Policies: Present insurance policies that include life insurance, health insurance, permanent disability insurance, property cover, and liability insurance.

- Identify Risks and Objectives

- Risk Identification: Possible financial risks such as death, illness, disability; damage to properties; liability issues; or commercial risks.

- Financial Objectives: Immediate and future monetary targets including funding for education, retirement planning, estate planning as well as debt repayments.

- Compute Coverage Needs

- Life Insurance: Assessing how much is needed for income replacement, loan repayment costs, educational expenses as well as funeral costs.

- Health Insurance: Determine whether there may be a need for any kind of medical coverage (outpatient treatment), dental care, and eyesight care while considering possible out-of-pocket outlays.

- Property and Casualty Insurance: gauging the worth of properties (houses, cars, business premises) and the expenses involved in replacing or mending them.

- Liability Insurance: Calculate the budget that would be necessary to guard against future lawsuits and indemnity claims.

- Evaluating Coverage Options:

- Policy Comparison: researching different kinds of insurance policies and providers for the best coverages as well as premiums.

- Cost-Benefit Analysis: making a comparison between the premium payments and benefits together with protection provided by the policies.

- Advice:

- Customized Solutions: presenting personalized recommendations regarding types and quantities of required insurance coverage; based on what has been analyzed.

- Adjustments: proposing changes to current coverage or advising new policies to address any shortcomings.

- Implementation and Review:

- Implementation: assisting with applying for as well as buying suggested insurance policies while still in line with financial needs.

- Periodic Review: routinely reviewing, revising, and altering these plans so they stay relevant regardless of shifting circumstances, aspirations for wealth accumulation, or market trends.

An Insurance Needs Analysis is beneficial in the following ways:

- Tailored Insurance: It is a customized risk cover designed specifically for people or organizations based on what they want and the situation they are in.

- Financial Security: Protection against expenses from unavoidable occurrences.

- Cost-Effectiveness: Prevents overspending and underspending on insurance premiums that are not required.

- 4. Mental Ease: Feeling relieved knowing that all possible threats have been considered, while still safeguarding your future finances.

- 5. An insurance needs analysis is significant as it enables one to build a comprehensive plan for covering his/her particular risks which ensures he/she will be safe as well as secure financially.

As word templates, we have a sample insurance needs analysis template that can be downloaded or you can directly access it in Google Docs by clicking on the button.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link