Stock Option Agreement

Sponsored Link高级模板 保存,填空,打印,三步搞定!

下载 下载 How to write a Stock Option Agreement? In what way do stock options serve their purpose? this Stock Option Agreement now! It includes a dispute resolution clause.

只有今天: USD 2.99

点击购买

可用的免费文件格式:

微软的词 (.docx)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (37.43 kB)

- 语: English

- 付款完成后,您将收到包含该文件的电子邮件。

Sponsored Link

How to write a Stock Option Agreement? In what way do stock options serve their purpose? Our Stock Option Agreement template is a simple and straightforward agreement that provides all the necessary provisions for granting stock options to employees. It includes a dispute resolution clause. Download this Stock Option Agreement now!

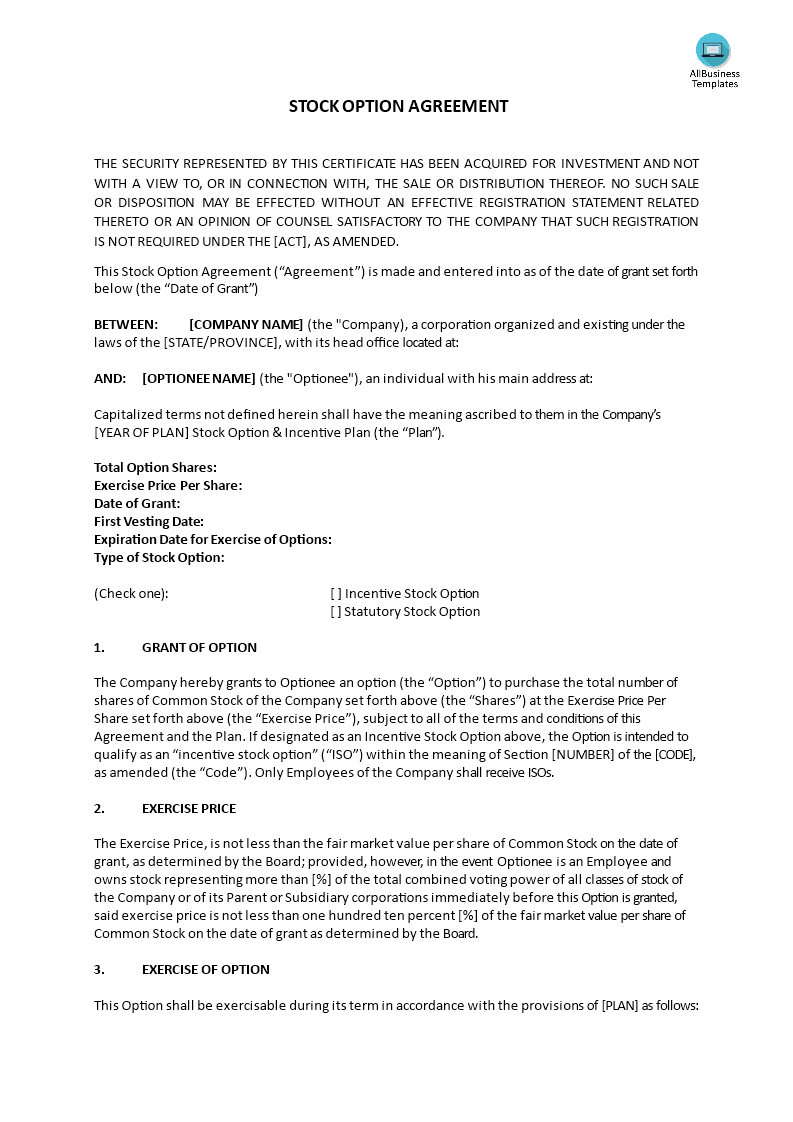

A Stock Option Agreement is a legally binding contract between a company and an individual (often an employee or consultant) that grants the individual the right to purchase a specific number of shares of the company's stock at a predetermined price, known as the exercise or strike price, within a specified period of time. This agreement is a common component of employee compensation packages, especially in startup companies and established corporations.

Key components of a Stock Option Agreement typically include:

- Grant Date: The date on which the stock options are awarded to the individual.

- Exercise Price: The price at which the individual can buy the company's stock when they choose to exercise their options. This price is usually set at or above the current market price of the stock at the time of the grant.

- Vesting Schedule: Stock options often have a vesting schedule that specifies when the options become exercisable. Vesting can be based on time (e.g., options vest over a period of four years with a one-year cliff) or performance milestones.

- Expiration Date: The date on which the options expire and can no longer be exercised. This is typically several years after the grant date.

- Number of Options: The total number of stock options granted to the individual.

- Exercise Period: The timeframe during which the individual can exercise their options, typically after they have vested. This can range from a few years to a decade or more.

- Taxation and Exercise Conditions: The agreement may outline the tax implications of exercising the options and any conditions or restrictions on exercising, such as blackout periods.

- Termination Conditions: Details about what happens to the options if the individual leaves the company or if the company undergoes certain events (e.g., acquisition, merger, or IPO).

Stock options are a way to align the interests of employees or other individuals with those of the company, as the value of the options typically increases as the company's stock price rises. They can be a valuable form of compensation and an incentive for individuals to contribute to the company's growth and success. However, it's important for individuals receiving stock options to carefully review the terms of the Stock Option Agreement and consider the potential risks and tax implications associated with exercising and holding stock options. Consulting with a financial advisor or attorney is often recommended when dealing with stock options.

Download this professional legal Stock Option Agreement template if you find yourself in this situation and save yourself time, and effort and probably reduce some of the lawyer fees! Using our legal templates will help you to reach the next level of success in your education, work, and business! However, we still recommend you to consider consulting a local law firm in case of doubt to support you in this matter.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link