Mileage Reimbursement Form

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Mileage Reimbursement Form

微软电子表格 (.xls)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (26 kB)

- 语: English

Sponsored Link

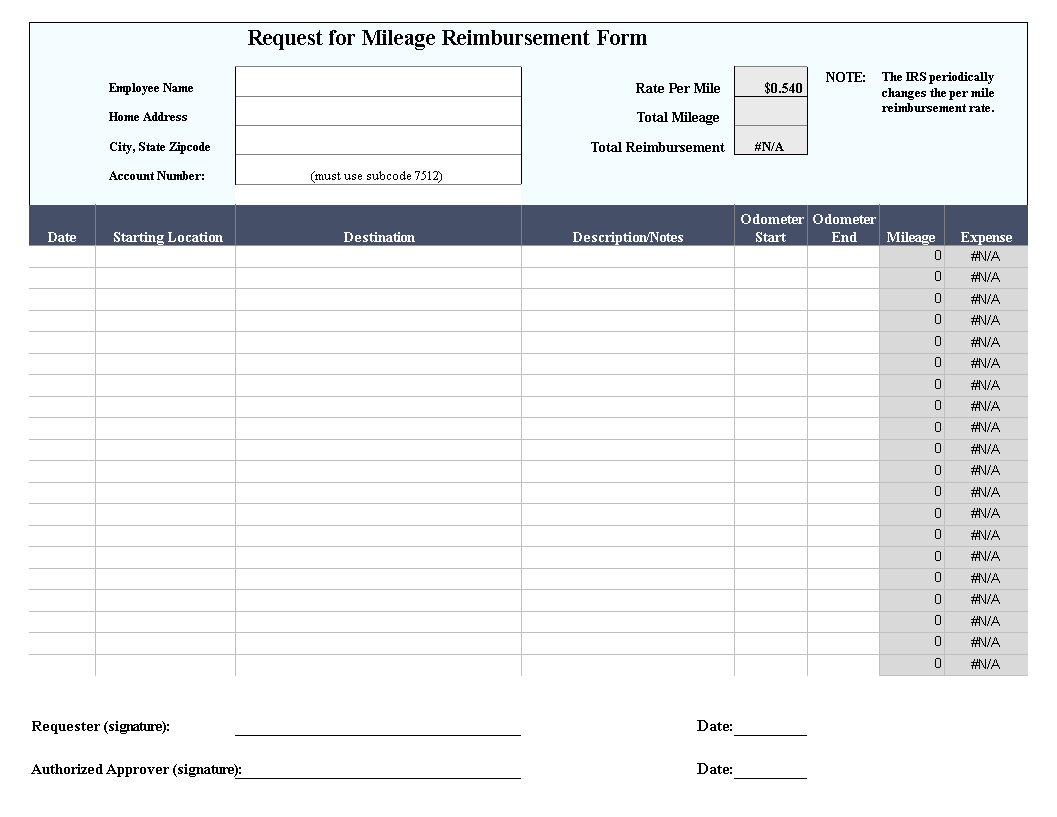

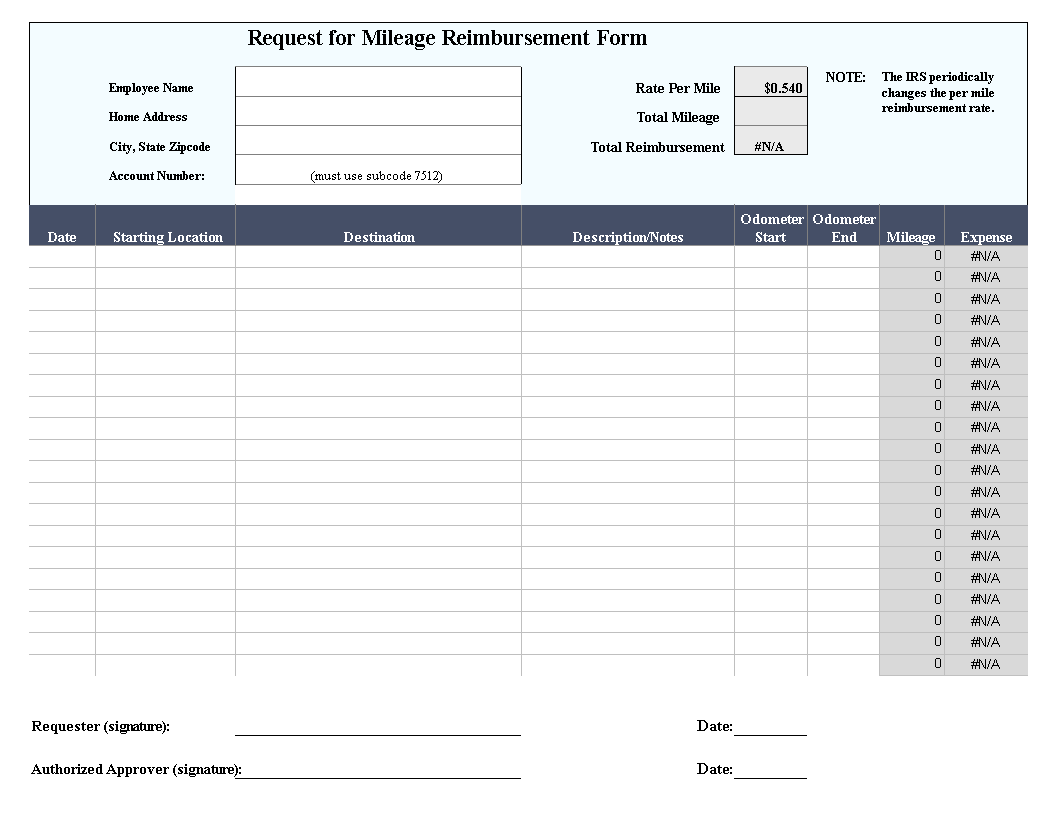

How to create a Mileage Reimbursement Form? An easy way to start completing your document is to download this example Mileage Reimbursement Form template now!

We provide this Mileage Reimbursement Form template to help professionalize the way you are keeping track of mileage data. This ready-made mileage log template can help you to save time and effort.

What is a Mileage Reimbursement Form?

To claim deductions on your tax returns, you have to keep meticulous records of your driving. Many people record the time weekly or monthly, which will not satisfy the IRS if there’s an audit of your records. The easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. The IRS has been known to disqualify some deductions because there wasn’t a clear separation between driving for business and other trips.

Along with a beginning record of the vehicle’s mileage at the beginning of the year, you’ll need a record at the end of the year too. This should match with the amounts that are recorded each day to ensure that the mileage is correct.

Example of reimbursement are: It's basically money paid to an employee, customer, or another party as a repayment for a business expense they have paid out of their own pocket. Expenses noted on the form may include business expenses, insurance costs and overpaid taxes (although reimbursement is not subject to taxation), office supplies, travel, accommodations, etc.

The following information must be recorded each time you begin your drive to a destination associated with business.

- The date of the business trip.

- Starting point for the trip. It could be the office or a job site.

- The ending destination for your trip.

- The purpose of your trip.

- Starting mileage on the vehicle.

- Ending mileage for that trip.

- Rate.

Each trip must be recorded as well as the beginning and ending mileage at the end of the day to ensure they are precise. The IRS also requires that you keep these records on file for three years after you use them for deductions.

Our log form templates are grid-based files designed to organize information and record data entries. Beginners and professionals from all over the world are now using log sheets to create tables, calculations, comparisons, overviews, etc. for any personal or small business need. By using this form guarantees you will save time, cost, and effort! It comes in Microsoft Office format, is ready to be tailored to your personal needs. An easy way to start completing your request for reimbursement form is to download this Claim Form template now! Download this Business Reimbursement Form template now for your own benefit!

This DOCx template is a great way to increase your productivity and performance. It gives you access to do remarkable new things with your Word Processor, even if you only have a basic understanding of it. If time or quality of making a useful simple log is of the essence, this ready-made form can certainly help you out! Just download this file directly to your computer, open it, fill in the data, or save it as a PDF, or print a clean log sheet directly.

Download this Mileage Reimbursement Form directly to your computer or check out other Mileage logs here as well.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link