Banking Compliance Officer Resume template

Sponsored Link免费模板 保存,填空,打印,三步搞定!

Download Banking Compliance Officer Resume template

微软的词 (.doc)免费文件转换

- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (22.5 kB)

- 语: English

Sponsored Link

How to grab your futures employers’ attention when you are applying for a new job as a Banking Compliance Officer? How to draft a Banking Compliance Officer Resume that will impress its viewers? Download this Banking Compliance Officer Resume template now!

There are a few basic requirements for a Resume. Every resume should contain the following:

This Banking Compliance Officer Resume template will grab your future employer its attention. After downloading and filling in the blanks, you can customize every detail and appearance of your resume and finish.

You just have to be a little more creative and follow the local business conventions. Also bright up your past jobs and duties performed. Often they are looking for someone who wants to learn and who has transferable skills like:

- Leadership skills;

- Can do-will do mentality;

- Ability to communicate;

- Ability to multi-task;

- Hard work ethics;

- Creativity;

- Problem-solving ability.

- brief, preferably one page in length;

- clean, error-free, and easy to read;

- structured and written to highlight your strengths;

- immediately clear about your name and the position you are seeking.

Completing your Banking Compliance Officer Resume has never been easier, and will be finished within in minutes... Download it now!

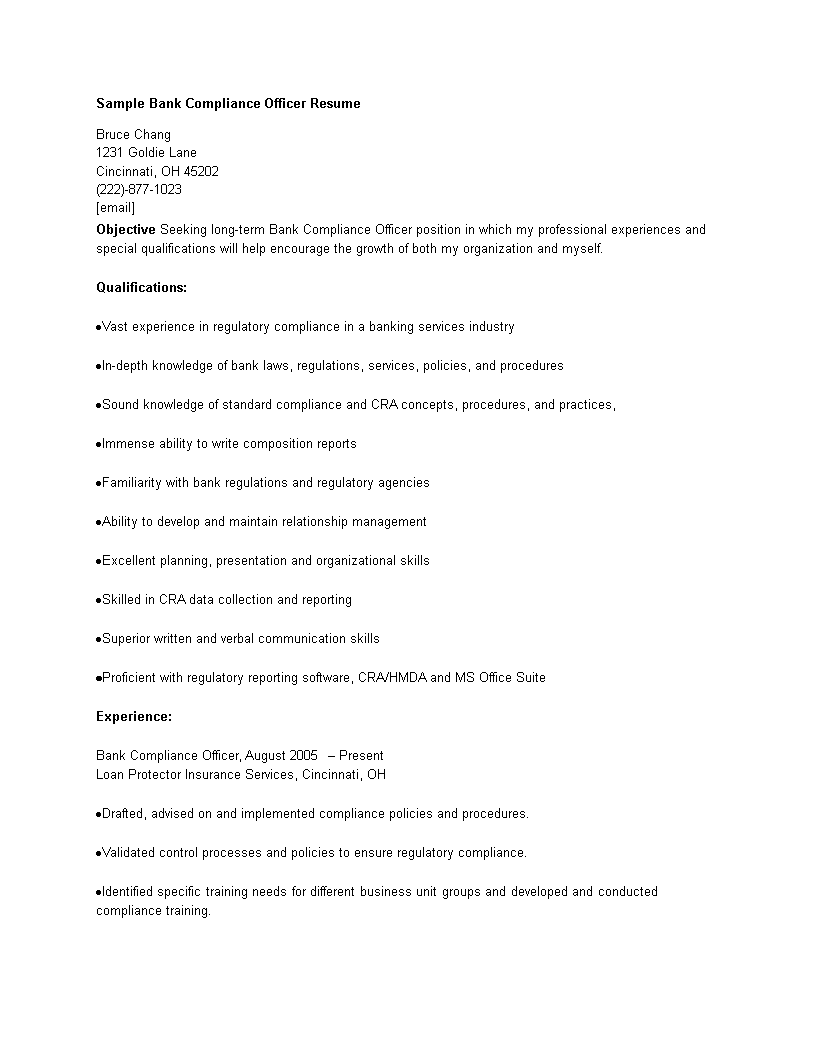

Qualifications: Vast experience in regulatory compliance in a banking services industry In-depth knowledge of bank laws, regulations, services, policies, and procedures Sound knowledge of standard compliance and CRA concepts, procedures, and practices, Immense ability to write composition reports Familiarity with bank regulations and regulatory agencies Ability to develop and maintain relationship management Excellent planning, presentation and organizational skills Skilled in CRA data collection and reporting Superior written and verbal communication skills Proficient with regulatory reporting software, CRA/HMDA and MS Office Suite Experience: Bank Compliance Officer, August 2005 Present Loan Protector Insurance Services, Cincinnati, OH Drafted, advised on and implemented compliance policies and procedures..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link