Assignment Of Accounts Receivable [With Recourse]

Sponsored Link高级模板 保存,填空,打印,三步搞定!

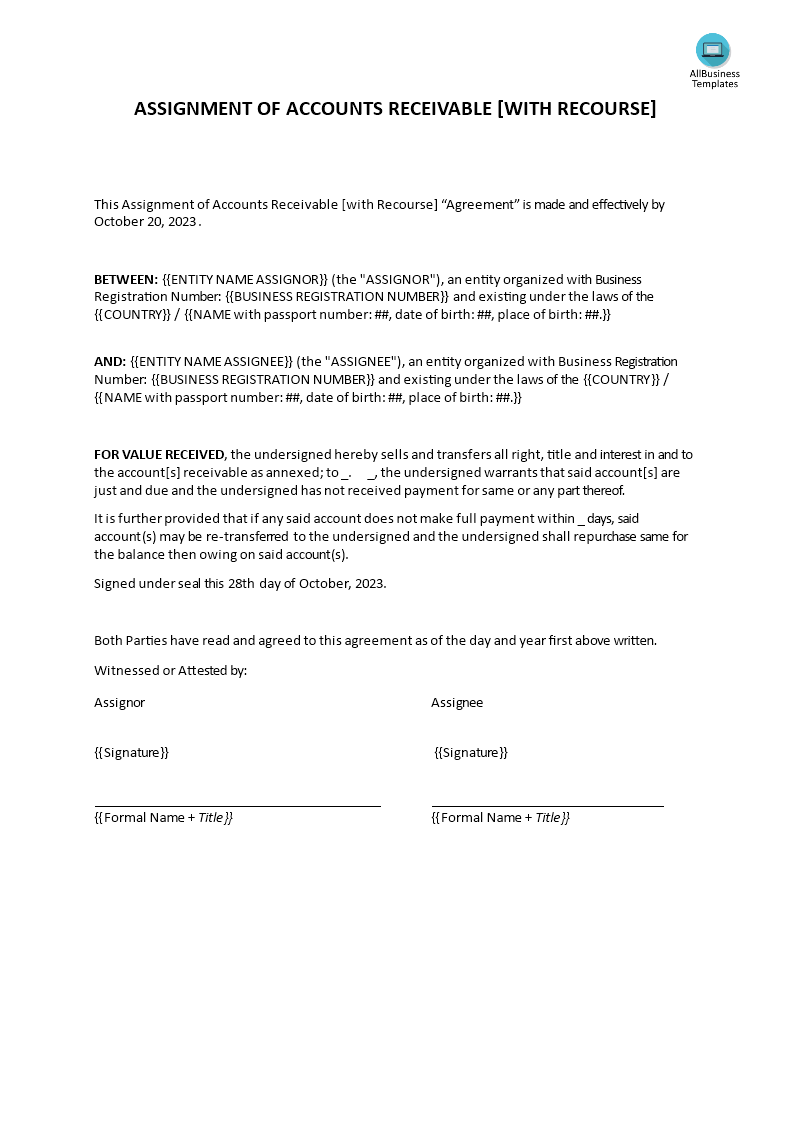

![Assignment Of Accounts Receivable [With Recourse] 样本图像 Assignment Of Accounts Receivable [With Recourse] 模板](/thumbs/6e04299e-3802-409d-b9f6-10da4f988dbc_1.png)

下载 下载 Do you need a Sample assignment of Accounts Receivable with Recourse? How is the assignment of receivables reported in the journal? this sample assignment of Accounts Receivable with Recourse

只有今天: USD 1.99

点击购买

可用的免费文件格式:

微软的词 (.docx)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (24.71 kB)

- 语: English

- 付款完成后,您将收到包含该文件的电子邮件。

Sponsored Link

Do you need a Sample assignment of Accounts Receivable with Recourse? How is the assignment of receivables reported in the journal? Our template has everything you need to get started. It includes detailed instructions, sample language, and a sample form. With it, you can easily assign accounts receivable to the right person. Download this professional Assignment Of Accounts Receivable [With Recourse] template now!

An "Assignment of Accounts Receivable with Recourse" is a financial arrangement in which a business (the assignor) transfers or assigns its accounts receivable to a third party, often a financial institution or a factoring company (the assignee), while retaining certain responsibilities and risks associated with those receivables. This type of assignment is referred to as "with recourse" because the assignor remains liable for the collection of the assigned receivables if the debtor fails to pay them.

Here's how an Assignment of Accounts Receivable with Recourse typically works:

- Transfer of Receivables: The business (assignor) sells or transfers its accounts receivable to the third-party entity (assignee). This transfer typically involves a purchase agreement that outlines the terms and conditions of the assignment.

- Retained Liability: In a "with recourse" arrangement, the assignor retains liability for the receivables. This means that if the debtor (the customer who owes money) fails to pay the assigned receivables, the assignor is responsible for repurchasing them from the assignee.

- Funding: The assignee provides immediate funds to the assignor based on the face value of the assigned receivables, minus a discount or fee. This allows the assignor to access cash flow quickly without waiting for customers to pay their invoices.

- Collection and Administration: The assignee takes over the responsibility for collecting payments from the debtors. They may handle billing, collections, and follow-ups with customers.

- Recourse Period: The purchase agreement specifies a recourse period during which the assignor is obligated to repurchase any delinquent receivables. This period could be defined by a certain number of days or based on other criteria, as agreed upon in the contract.

- Recourse Obligations: If a debtor fails to pay a receivable during the recourse period, the assignor must buy back that receivable from the assignee at an agreed-upon price, which may include the full face value plus interest or other fees.

- Risk Mitigation: The assignor may use this arrangement to mitigate credit risk and improve cash flow. If a customer defaults, they can repurchase the debt and pursue collections themselves.

Assignment of accounts receivable with recourse is often used by businesses, especially those in industries with longer payment cycles, as a means to obtain working capital, manage cash flow, and transfer some collection responsibilities while retaining control and responsibility for the ultimate payment of the receivables.

We support you by providing this Assignment Of Accounts Receivable [With Recourse] template and you will see you will save time and increase your effectiveness. This comes with the benefit you will be inspired and motivated to finish the job.

Download this professional Assignment Of Accounts Receivable [With Recourse] template now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link