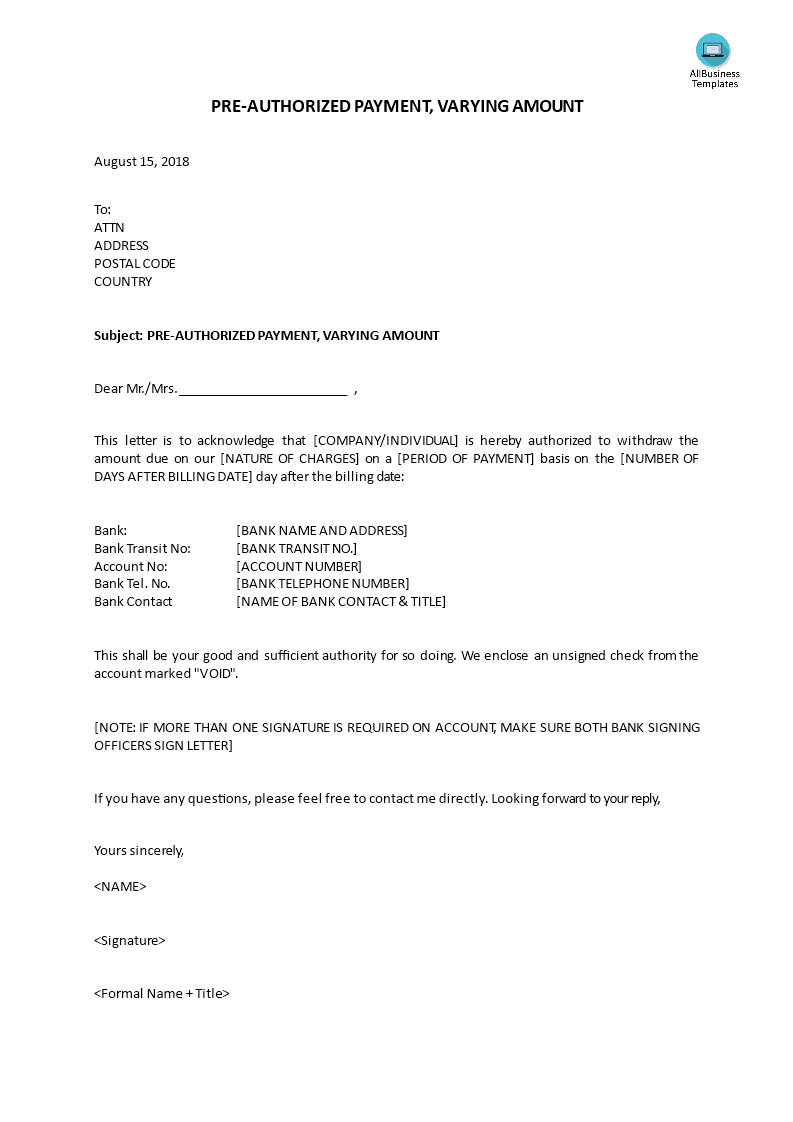

Pre-Authorized Payment

Sponsored Link高级模板 保存,填空,打印,三步搞定!

下载 下载 Do you need a Pre-Authorized Payment? Why is a preauthorized payment necessary? our sample template for pre-authorized payment now and use it as guide in writing your own template!

只有今天: USD 1.49

点击购买

可用的免费文件格式:

微软的词 (.docx)- 本文档已通过专业认证

- 100%可定制

- 这是一个数字下载 (25.16 kB)

- 语: English

- 付款完成后,您将收到包含该文件的电子邮件。

Sponsored Link

Do you need a Pre-Authorized Payment? Why is a preauthorized payment necessary? Our pre-authorized payment template is free to download and you can customize it to fit your needs. It covers all the necessary information and is easy to use. Download our sample template for pre-authorized payment now and use it as a guide in writing your own template!

A pre-authorized payment (PAP), also known as a pre-authorized debit (PAD) or automatic payment, is a financial arrangement in which a payer provides authorization to a payee (typically a business or service provider) to withdraw funds from the payer's bank account on a recurring basis to satisfy a financial obligation. These recurring payments are often used for bills, subscriptions, loan payments, and various other regular expenses. Pre-authorized payments offer convenience and ensure that payments are made on time without requiring manual intervention for each transaction.

Here are some key characteristics and important points to understand about pre-authorized payments:

- Authorization: To set up a pre-authorized payment, the payer must provide explicit authorization to the payee, granting permission to debit their bank account for specific amounts on specific dates or at regular intervals. This authorization is usually provided by completing a form or agreement, which may be paper-based or electronic.

- Types of Pre-Authorized Payments:

- Utility Bills: Common pre-authorized payments include payments for utilities like electricity, water, and gas.

- Subscriptions: Many subscription-based services, such as streaming platforms and magazines, offer pre-authorized payment options.

- Loan Payments: Borrowers often set up pre-authorized payments for loan repayments, including mortgages, auto loans, and personal loans.

- Membership Fees: Membership organizations and gyms may use PAPs for monthly dues.

- Insurance Premiums: Insurance companies may offer PAPs for policy premium payments.

- Frequency: Pre-authorized payments can occur on various schedules, including monthly, bi-monthly, quarterly, annually, or according to a custom schedule specified in the authorization agreement.

- Amount: The payer typically specifies the amount to be debited for each payment, which may be a fixed amount, a variable amount based on usage or consumption, or a percentage of the total bill.

- Notification: In many cases, payees are required to provide advance notice of upcoming pre-authorized payments. This notice allows payers to review the payment details and ensure they have sufficient funds in their bank account.

- Flexibility: Payers have the flexibility to cancel or modify pre-authorized payments by notifying the payee or their financial institution. They may also be able to set limits on the maximum amount that can be withdrawn.

- Consumer Protections: Depending on the jurisdiction, there may be consumer protection regulations in place to govern pre-authorized payments. These regulations often include requirements for clear authorization, notification, and dispute resolution processes.

- Bank Account Verification: Before initiating pre-authorized payments, payees may verify the payer's bank account to ensure the accuracy of the account information provided.

Pre-authorized payments offer convenience for both payers and payees, as they reduce the need for manual bill payments and help ensure that bills are paid on time.

Download this Pre-Authorized Payment template now!

For more business templates? Just browse through our database and website! You will have instant access to thousands of free and premium business templates, legal agreements, documents, forms, letters, reports, plans, resumes, etc., which are all used by professionals in your industry. All business templates are ready-made, easy to find, wisely structured, and intuitive.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

发表评论。 如果您有任何问题或意见,请随时在下面发布

相关文件

Sponsored Link